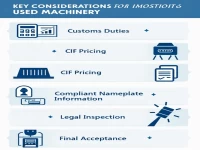

Key Considerations for Importing Used Equipment

When importing complete sets of mechanical equipment, it is essential to pay attention to tariffs and value-added tax rates, ensuring the accuracy of the declared price and customs codes. Additionally, consistency in nameplate information and compliance with inspection procedures is crucial. After assembly and debugging at the usage location, passing customs acceptance is required before production can commence.